Cash vs. Accrual Accounting —What Every Contractor Should Know

At Southbrook Accounting, we work with contracting businesses every day. One of the biggest shifts that can truly improve your financial clarity and help you grow with confidence is moving from cash-based accounting to accrual-based accounting.

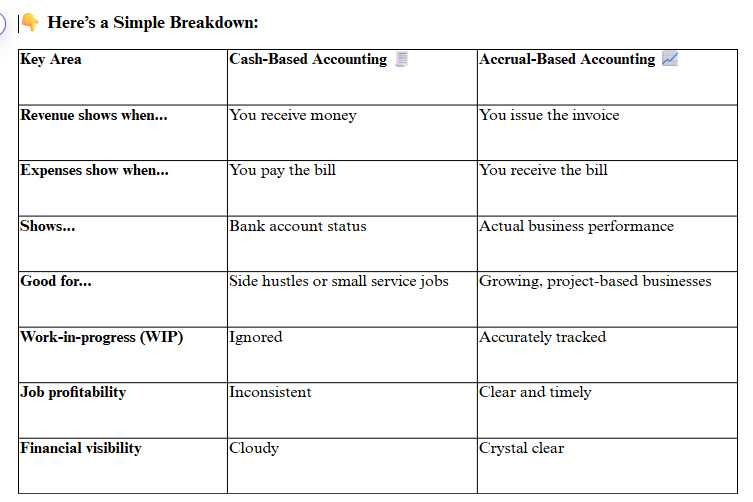

Cash Accounting:

You record income when you get paid and expenses when you pay the bill. It’s like managing your checkbook — only what’s in or out of your bank accounts.

Accrual Accounting:

You record income when you earn it (even if you haven’t been paid yet) and expenses when you receive the bill (even if you haven’t paid it yet). It gives a more accurate picture of how your business is really doing.

But what’s the real difference — and why does it matter?

💡Why Accrual Accounting Just Makes Sense

If you’re building homes, managing crews, or running multiple jobs at once — you’re already juggling complexity. Accrual accounting gives you a financial system that matches that reality.

It helps you:

- Give consistent Monthly Profit & Loss statements (no more big swings each month)

- Understand which jobs are truly profitable

- Stay ahead of cash flow issues

- Make confident growth decisions

- Show stronger financials to banks, buyers, or investors

FREE DOWNLOAD: “Why Profit Doesn’t Mean Cash – and What to Do About It”

A 1-page cheat sheet every contractor should stick on their wall.

Most owners assume if they’re profitable, they’re flush with cash. This guide shows why that’s not always true — and how accrual accounting clears the fog.

✅ 3 common contractor cash traps

✅ Why profit ≠ cash (with a simple visual)

✅ Nathan’s Rule of 3 for project cash flow

✅ A spot to track your monthly WIP – see Download

DOWNLOAD YOUR MONTHLY WIP SCHEDULE

💬 Our Take

“Tracking WIP is only possible under accrual — it’s how you actually see the financial heartbeat of your projects.”

Switching to accrual accounting can feel like a leap — but it’s one of the best decisions you can make as a contractor.

At Southbrook Accounting, we help make the transition clear, simple, and tailored to your business.

Want to get some clarity? Let’s talk Accrual and Monthly WIP.